Predatory lending practices in the car title loan industry trap borrowers in debt by hiding fees and high interest rates. Advocates push for consumer protection reforms including transparent lending, accessible applications, and vehicle inspections to empower borrowers and prevent cycles of debt. Strengthening regulations aims to create a fair market while safeguarding individuals' most valuable asset: their vehicles.

In recent years, advocates have been fighting tirelessly for Car title loan consumer protection reform, targeting predatory practices that leave borrowers in a cycle of debt. This article delves into the dark underbelly of the car title loan industry, exploring how unscrupulous lenders exploit vulnerable consumers. We’ll examine empowering measures to safeguard rights and discuss actionable reforms needed to navigate this complex landscape. By shedding light on these issues, we aim to catalyze meaningful change for better consumer protection.

- Uncovering Predatory Practices in Car Title Loans

- Empowering Consumers: Rights and Safeguards

- Navigating Reform: A Call for Change in Action

Uncovering Predatory Practices in Car Title Loans

In the quest for Car title loan consumer protection, a closer look at the lending practices within this industry is essential. Unscrupulous lenders often employ predatory strategies, taking advantage of vulnerable borrowers. One common tactic involves offering quick loan approval with minimal to no credit check, targeting individuals in desperate financial situations. This approach masks hidden fees and sky-high interest rates, making it difficult for borrowers to repay the loans on time.

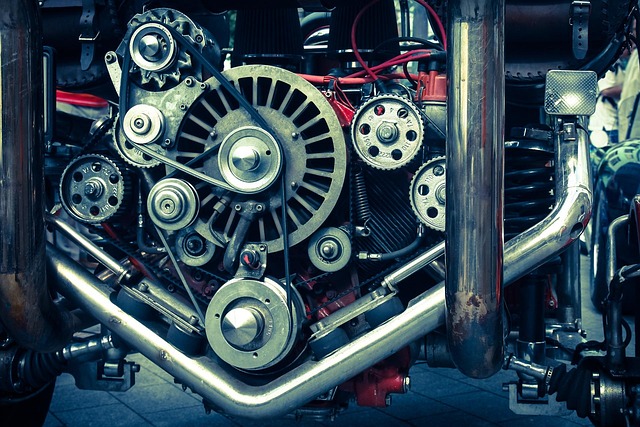

Moreover, these lenders may require vehicle ownership as collateral, providing them with a sense of security but leaving borrowers at risk. The lack of transparency and stringent terms can trap individuals in cycles of debt, exacerbating their financial struggles. Recognizing these predatory practices is paramount in the ongoing efforts to advocate for Car title loan consumer protection reforms, ensuring fair lending standards, and empowering borrowers to make informed decisions regarding their vehicles and finances.

Empowering Consumers: Rights and Safeguards

Advocates for Car Title Loan Consumer Protection Reform aim to empower borrowers by providing them with clear rights and safeguards. This includes ensuring transparent and fair lending practices, where consumers are fully informed about interest rates, repayment terms, and potential fees associated with car title loans. By strengthening regulations, borrowers can make informed decisions without falling into cycles of debt.

These reforms also emphasize the importance of accessible and user-friendly online application processes, offering convenience while maintaining security standards. Additionally, consumer protection measures may include mandatory vehicle inspections to assess the true value of the collateral, preventing lenders from overvaluing assets and ensuring borrowers receive fair loan extensions based on genuine market values.

Navigating Reform: A Call for Change in Action

Navigating the complex landscape of car title loan consumer protection reform is a challenging yet crucial endeavor. With interest rates often exorbitant and terms opaque, many borrowers find themselves trapped in cycles of debt. Houston Title Loans, like many others across the nation, have been subject to criticism for leveraging vehicle equity in ways that can leave consumers vulnerable.

Advocates are calling for meaningful change, pushing for regulations that ensure transparency, cap excessive interest rates, and protect borrowers from predatory lending practices. By implementing these reforms, policymakers aim to create a fairer market where individuals facing financial hardship can access short-term funding without risking the loss of their most valuable asset—their vehicle.

In light of the above discussions, it’s clear that reform in car title loan consumer protection is both necessary and urgent. By uncovering predatory practices and empowering consumers with knowledge about their rights, we can navigate a path towards more ethical lending. Advocating for change in action will ensure that those seeking short-term financial solutions are protected and treated fairly. Together, we can revolutionize the car title loan industry and foster a safer financial landscape for all.