Car title loan consumer protection is vulnerable to high-risk lenders and online platforms like Fort Worth Loans, with loopholes in regulations and complex terms. Online applications can lead to predatory lending, trapping borrowers in debt and risking vehicle loss. To protect consumers, especially for specialized loans, financial institutions and regulators must collaborate on simplifying processes, promoting transparency, and establishing robust frameworks against risky terms and high interest rates.

In today’s financial landscape, car title loans have emerged as a popular yet potentially risky borrowing option for many. While regulations aim to protect consumers, gaps in car title loan consumer protection remain, leaving vulnerable borrowers at risk. This article delves into the weaknesses of current protections, examining their impact on those with limited financial resources. We propose comprehensive solutions to enhance safety, ensuring fair lending practices and safeguarding consumers who rely on these loans as a last resort.

- Uncovering Weaknesses in Current Protections

- The Impact on Vulnerable Borrowers

- Proposing Comprehensive Solutions for Safety

Uncovering Weaknesses in Current Protections

The current framework for car title loan consumer protection has its vulnerabilities, which often leave borrowers at a disadvantage. Despite regulations aimed at safeguarding consumers, loopholes and gray areas exist, especially when it comes to high-risk lenders and online platforms. Many traditional protections may not adequately address the unique challenges faced by individuals seeking bad credit loans, particularly through digital channels like Fort Worth Loans applications.

For instance, while disclosure of terms and conditions is mandatory, the complexity of these loans and their associated risks can be overlooked or misunderstood by borrowers. Online application processes might offer convenience but could also facilitate access to predatory lenders who exploit borrowers’ urgency for quick cash. This is particularly concerning in regions with limited financial literacy resources, where consumers may be more vulnerable to unfair practices.

The Impact on Vulnerable Borrowers

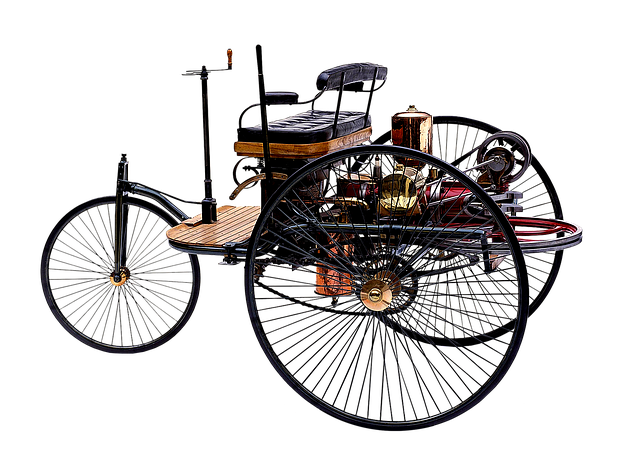

Vulnerable borrowers often find themselves drawn to car title loans as a means of securing quick funding and financial assistance during times of crisis. These short-term, high-interest loans can provide much-needed relief, but they also come with significant risks. Without robust consumer protection measures in place, these borrowers may fall into a cycle of debt that is difficult to escape.

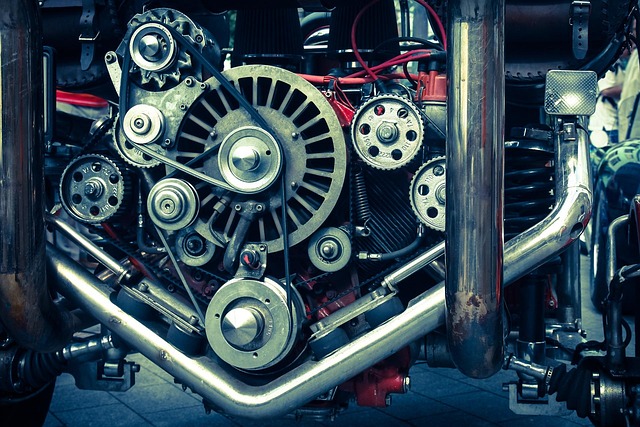

Car title loans, due to their nature, target individuals who might be desperate for cash and less equipped to understand the full implications of such loans. The flexibility of payments can mask hidden fees and sky-high interest rates, making it challenging for borrowers to regain financial stability. As a result, many vulnerable consumers risk losing their vehicles—a significant blow to their mobility and means of livelihood—if they are unable to repay these titles loans on time.

Proposing Comprehensive Solutions for Safety

In an effort to enhance Car title loan consumer protection, it’s imperative to propose comprehensive solutions that prioritize safety and transparency. The current landscape reveals gaps that leave consumers vulnerable, especially those seeking emergency funding options like Semi Truck Loans. These loans, while beneficial for specific industries, often come with stringent terms and high-interest rates, making them a risky choice without adequate safeguards.

To mitigate these risks, financial institutions and regulatory bodies must collaborate to establish clear guidelines and robust frameworks. This includes simplifying loan approval processes to ensure consumers fully understand the implications of borrowing against their vehicle equity. By promoting responsible lending practices, we can empower borrowers while protecting them from predatory lending schemes, fostering a safer and more equitable credit market.

In exploring gaps within car title loan consumer protection, it’s evident that enhancing regulations is crucial to safeguard vulnerable borrowers. By addressing weaknesses in current protections, we can foster a more transparent and equitable lending landscape. Proposed comprehensive solutions aim to empower consumers, ensure fair practices, and prevent predatory lending, ultimately leading to improved financial well-being for all borrowers seeking car title loan options. Strengthening consumer protection is not just desirable; it’s a necessary step towards a fairer and safer borrowing environment.